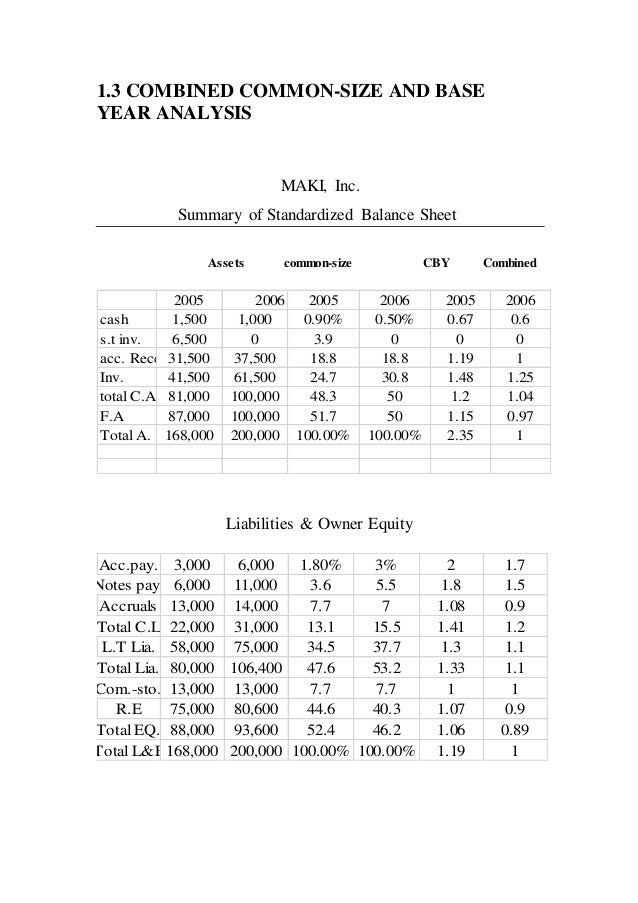

Smart Common Size Percentage Balance Sheet Narrative Format

The common figure for a common size balance sheet analysis is total assets.

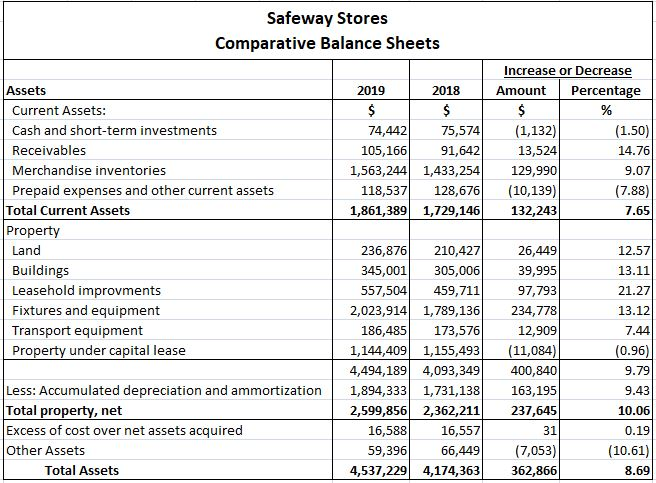

Common size percentage balance sheet narrative format. Sarah Bock Last modified by. This percentage change in assets and liabilities is mentioned in Column V of the comparative balance sheet. Percentage Change Absolute Increase or DecreaseAbsolute Figure of the Previous Years Item 100.

In other words each asset is expressed as percentage to total assets and each item of equity and liability is expressed as percentage to total. SAMPLE BALANCE SHEET in narrative format Author. Remember on the balance sheet the base is total assets and on the income statement the base is net sales.

The formula used in common size analysis is. Common size balance sheet. Discusses techniques in Excel for creating a common size balance sheet.

Amount Base amount and multiply by 100 to get a percentage. The common size balance sheets however shows that as a proportion of total assets accounts receivable has remained fairly constant at 277 and 272 of total assets. Common size balance sheets are.

All percentage figures in a common-size balance sheet are percentages of total assets while all the items in a common-size income statement are percentages of net sales. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets total liabilities and equity accounts. This format is useful for comparing the proportions of assets liabilities and equity between different companies particularly as part of an industry analysis or an acquisition analysis.

This format presents not only the standard information contained in a balance sheet but also a column that notes the same information as a percentage of the total assets for asset line items or as a percentage of total liabilities and shareholders equity for liability or shareholders equity line items. 3102006 65900 AM Company. Common Size Amount Analysis Amount Base Amount x 100 The base amount will change depending on whether the company is completing its analysis on.